Give your kids & grandkids a financial head start for life

Be part of the growing community of Australians setting up their child's future.

Golden Goose Gifting

It’s an easy way to regularly make small contributions to a child’s superannuation account.

What are the benefits of Golden Goose Gifting?

There are four key benefits that make Golden Goose Gifting an attractive way to help:

- The money is secure in a super account – the child won’t be able to access the funds unless they meet a condition of release.

- The money is professionally managed.

- Super is a concessionally taxed investment method.

Our CEO Andrew, talks about the origins of Golden Goose Gifting

How much does it cost?

One of the great advantages of contributing to a child’s super account is the cost-effectiveness.

You don’t pay a fee to make a contribution to a child’s super account. The only fees that apply are the normal fees for the super fund account;

- We have zero admin fees for balances under $1,000 (see our Fees & discounts page or PDS for further details).

- Once the member’s balance reaches $1,000, they will automatically be enrolled in our loyalty discount program. You can see a breakdown of all fees on our fees and discounts page

How to get started

If the child is under the age of 18, their parent or guardian can easily set up an account in their name.*

- You can begin the process and we’ll email the parent or guardian to finish setting up the account. Start here

- The parent or guardian will need to apply for a Tax File Number (TFN) for the child and they will be able to add it to the child’s account.

- Once the child’s TFN is added to their account, the parent or guardian will be able to access the details to make a contribution to the child’s super account. Ask the parent or guardian to share this information with you.

* The process for contributing to the super account of a child aged 18 or older is different. For more information, refer to the FAQs below.

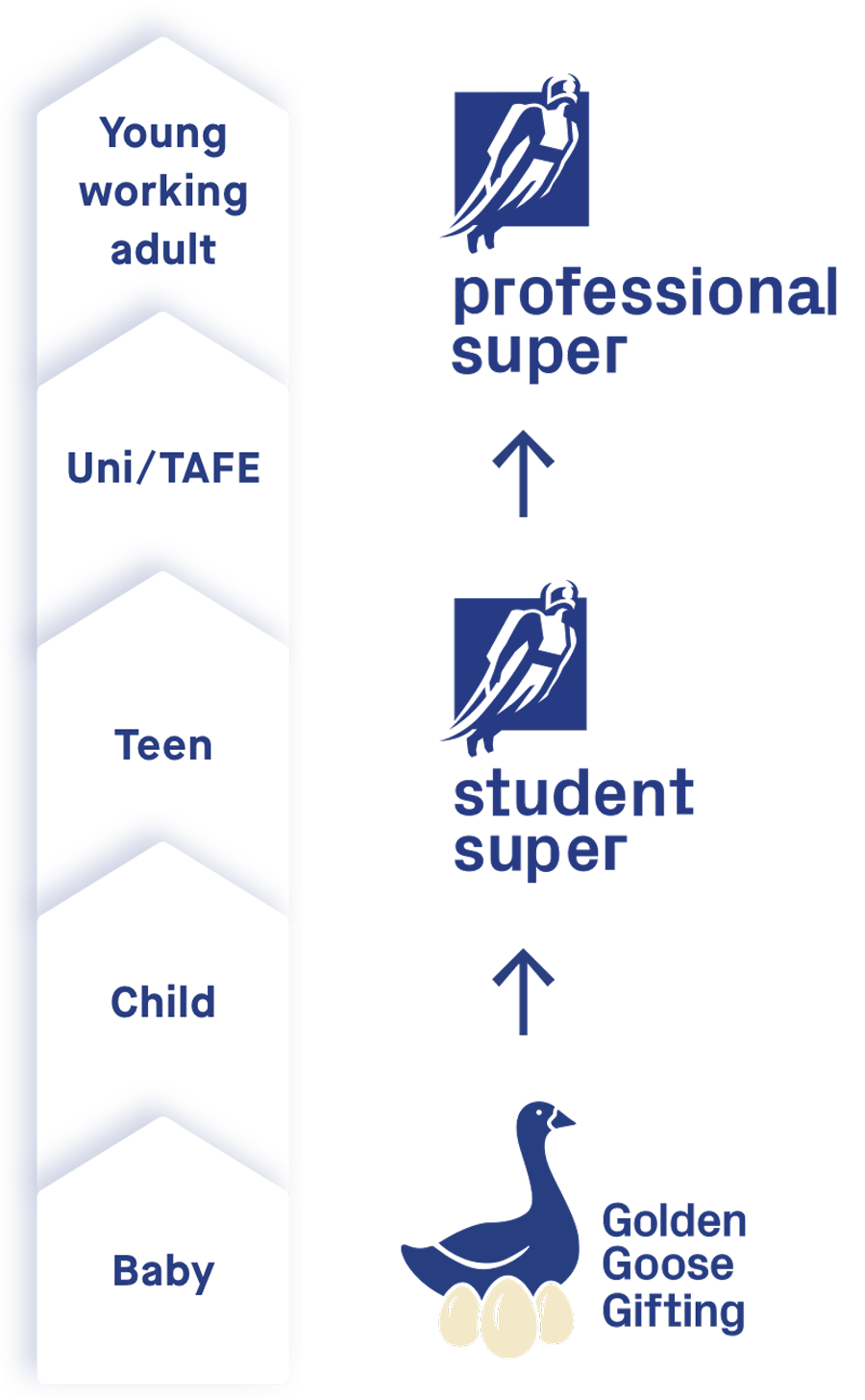

Who is Student Super?

Student Super is an APRA regulated super fund that specialises in superannuation for young Australians.

Typically our members are high school and university students. The fund has been built around their specific needs.

When they graduate

The brand changes name to “Professional Super”. The fund stays the same, but the Professional Super website has educational resources that are designed for young adults in the workplace - like using super to save tax effectively for a first home!

An additional advantage of Golden Goose Gifting

As the child becomes a teen and starts their first job, they’ll already have an account established with a super fund that can help them learn about super and get organised for their first job.

Student Super accounts are professionally managed

All Student Super accounts are professionally managed.

The super fund is regulated by APRA and under the stewardship of an independent trustee (Diversa).

Our delivery partners

Got a question?

What is Golden Goose Gifting?Show answer

How does it work?Show answer

How much can you contribute?Show answer

What does this mean for my tax?Show answer

How does the ATO treat contributions to a child’s super account?Show answer

My parents want to contribute to my child’s account – how can they do this?Show answer

How do I change a recurring contribution amount?Show answer

How can I check if my child has received a contribution?Show answer

Are there minimum commitments?Show answer

What are the differences between contributing for a child under and over 18?Show answer

More questions – we're here to help

I’m Bella from the support team at Student Super. Our team can answer any questions you have. Chat with us online or send us an email at hello@studentsuper.com.au.