Student Super's Year in Review 2021

2021 was a big year! It’s great to see our members getting their super organised.

Check out our facts for the year:

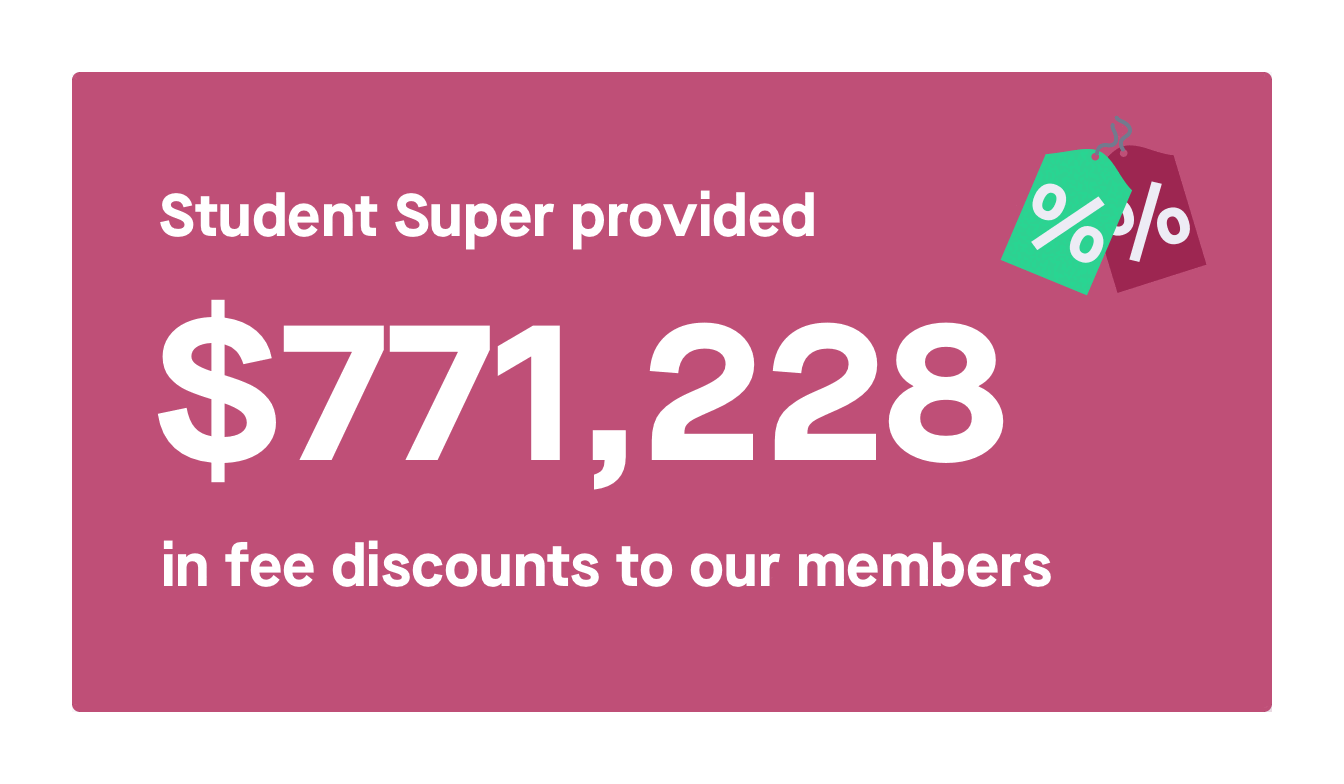

Our members are getting a head start on their super, which can make a big difference to their future. It is especially important if you’re working casual or part-time where fees can erode your super balance.

We help our members find old and lost super funds. This could happen if they’ve worked a few casual jobs and ended up with multiple super funds.

Multiple funds = multiple fees.

Once they’ve found the super, they can decide to consolidate them into Student Super. This means our members know exactly where their super is. Remember - super is your money.

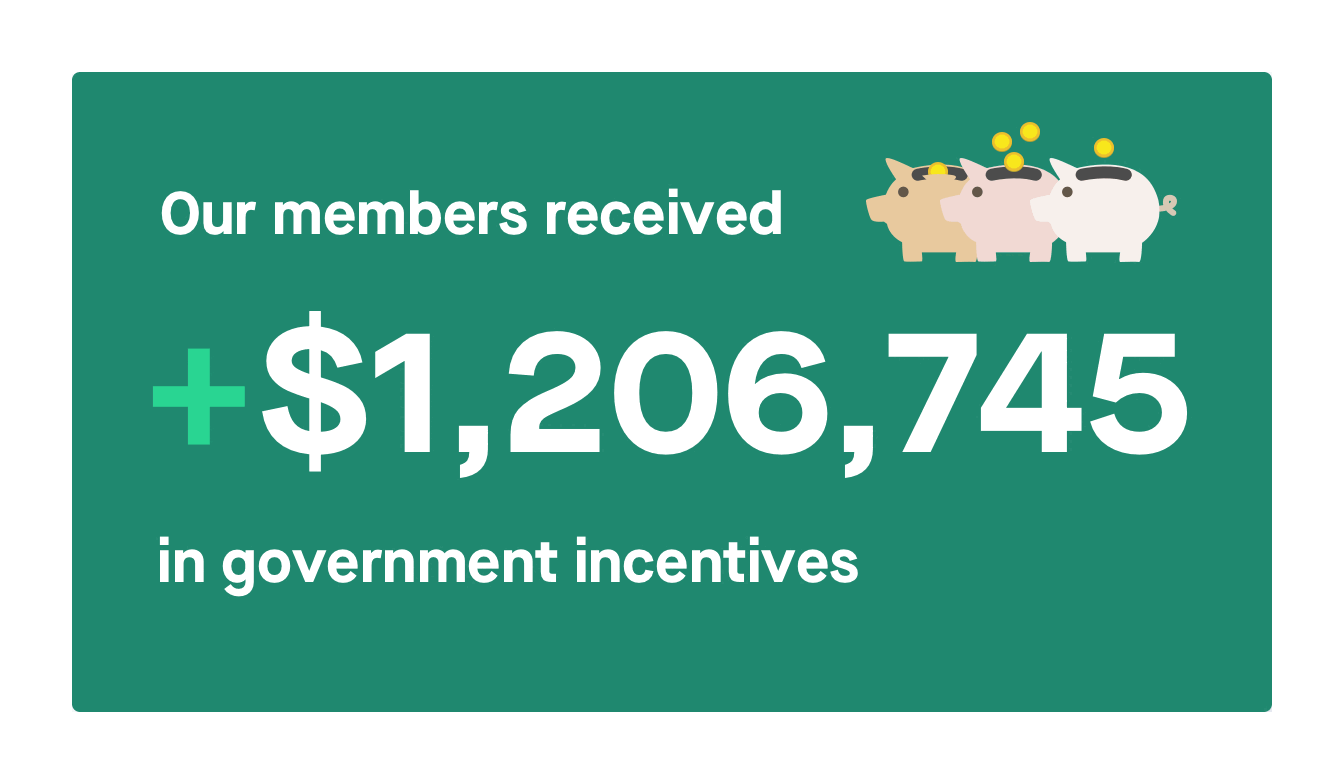

We think it’s important to keep our members in the loop about the government incentive schemes available that can help them grow their super. Knowledge is power!

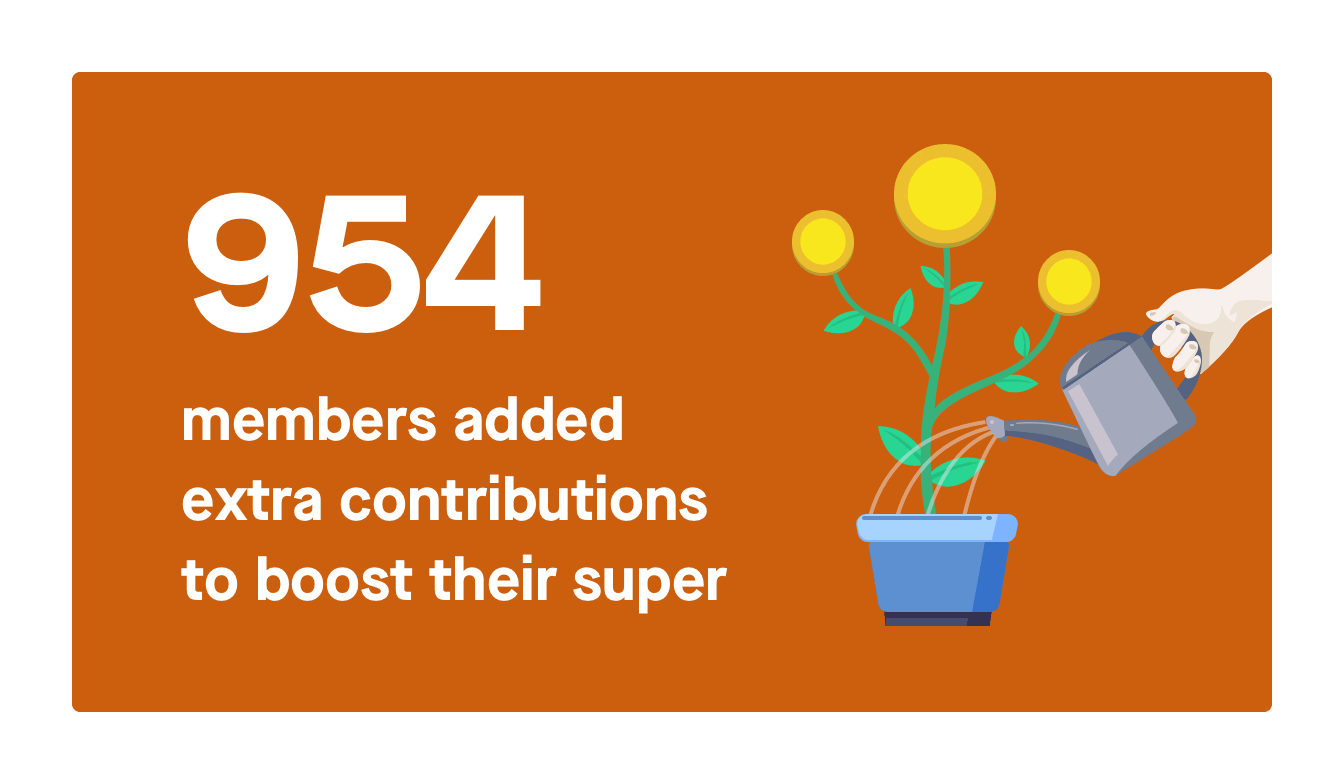

We love to see that our members are boosting their super while they’re young. If you meet the eligibility requirements, you could also take advantage of government co-contribution and tax incentives available.

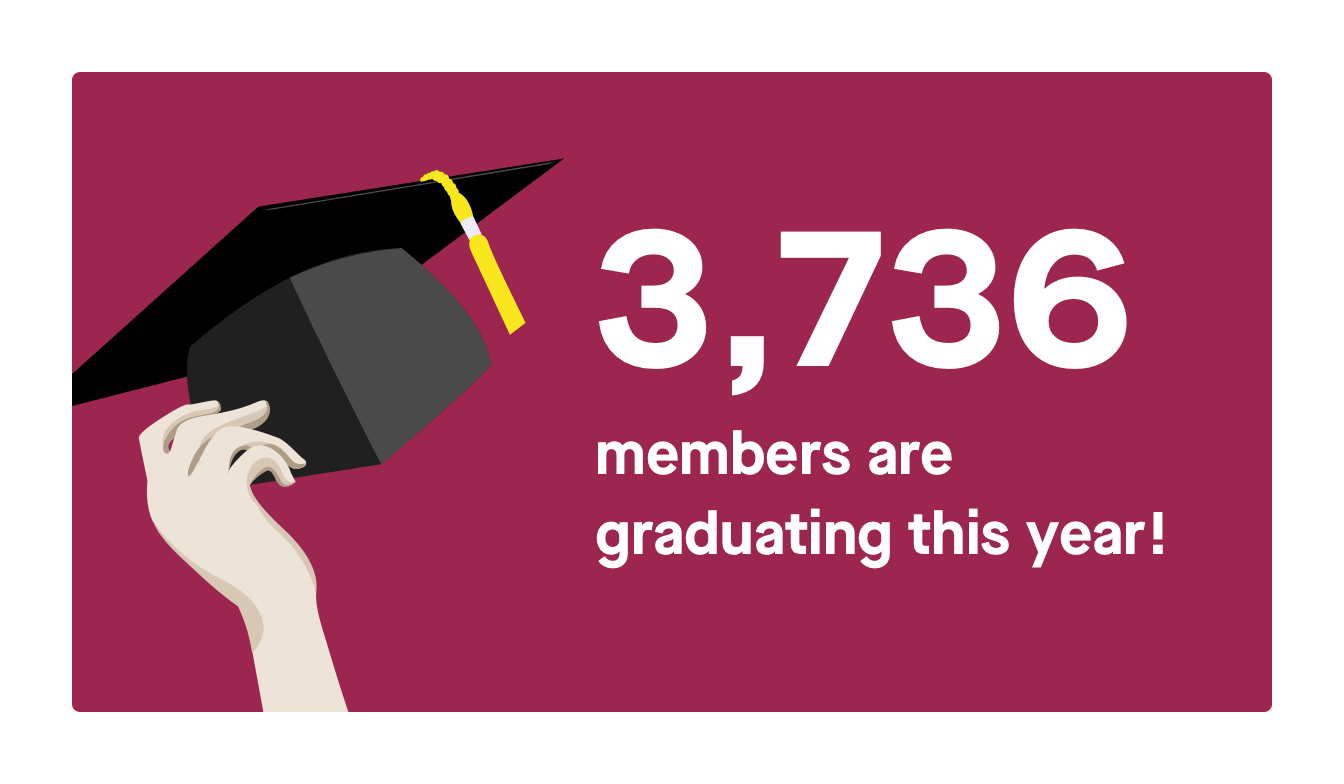

Woohoo - congrats to the class of 2021!

We stay with our members when they graduate. We help them get organised, and then stay organised with their super

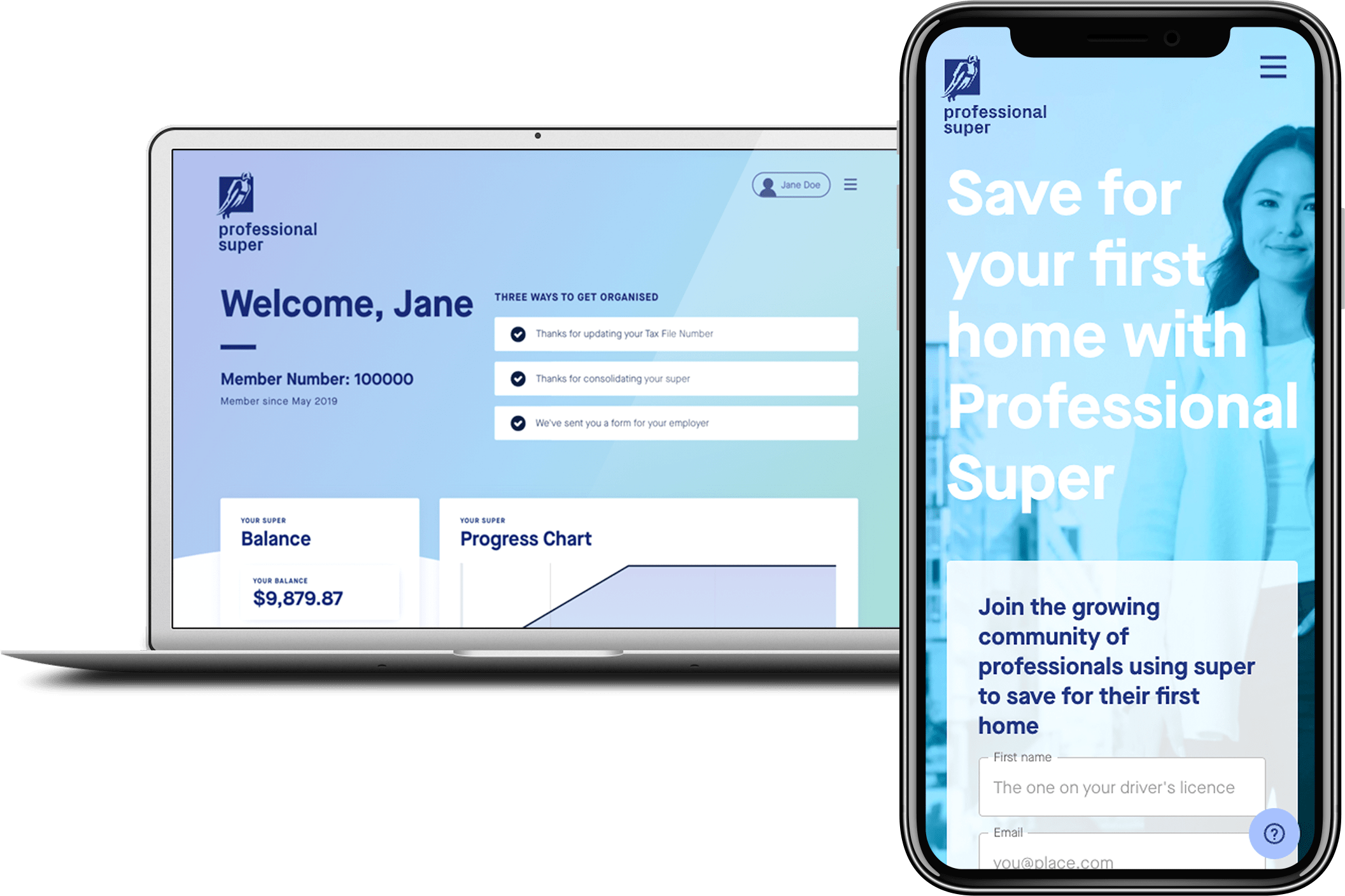

We’re one super fund with two websites.

Our members can use the Professional Super website if they are beginning to work full-time and are getting interested in building wealth and saving for their first home.

Members keep the same member number and their login details are the same.

And because there is still only one fund, there is no difference in investment options, fees and discounts. It’s the same fund.

Members can use both websites at any time.

We’re really glad you’ve been a member with us this year.

If you have any questions or feedback, please reach out to us by:

- ●Email at hello@studentsuper.com.au

- ●Call us on 1300 646 960 between 9am to 5pm AEST, Monday to Friday

Cheers,

The Student Super Team

The Year in Review is based on the fund’s data from 1 January 2021 to 31 December 2021.

The information on this page is current up to 31 December 2021. You should consider the current Product Disclosure Statement, Reference Guide, Financial Services Guide and Target Market Determination before making a financial decision about this product.