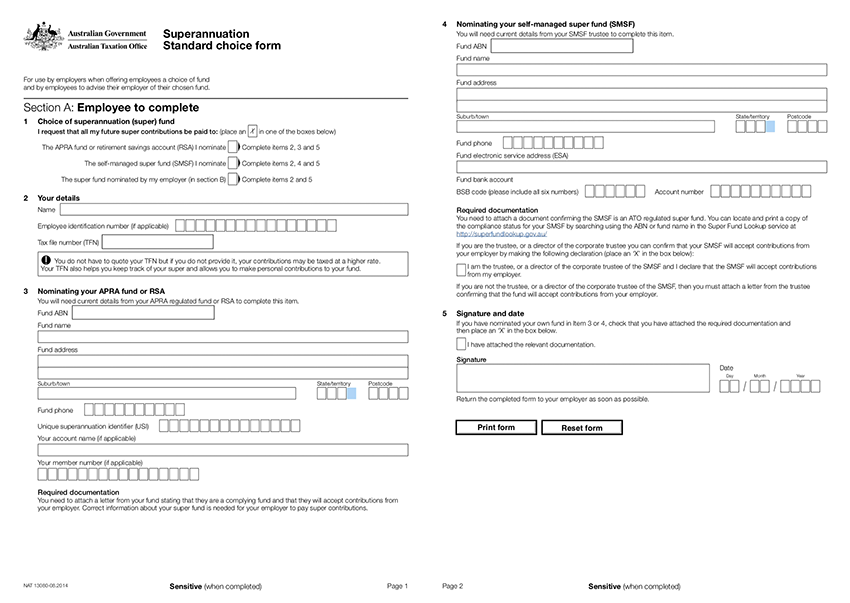

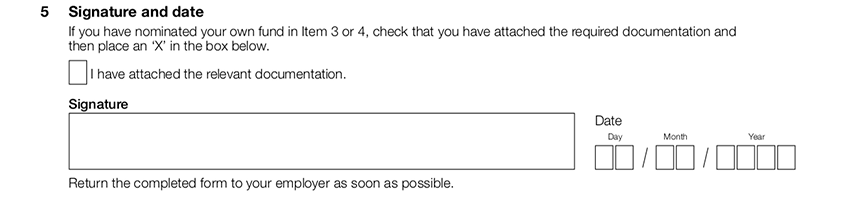

When you start at a new job, or change super funds during your job, there are a few forms you’ll have to give to your employer. One of these forms is the Superannuation (super) Standard Choice Form.

It’s a short form with three sections and as an employee, you only need to fill out Section A. This is what the form looks like:

Student Super’s pre-filled form

Student Super has made it easy for members by creating a pre-filled version of this form. Student Super mails out three printed copies of this form to every new member, and you can download another copy

here at anytime.

Filling out the ATO’s standard choice form

It can be a bit confusing to figure out what goes where, so we’ve made it a little easier with this handy guide on how to fill out the Super Standard Choice Form!

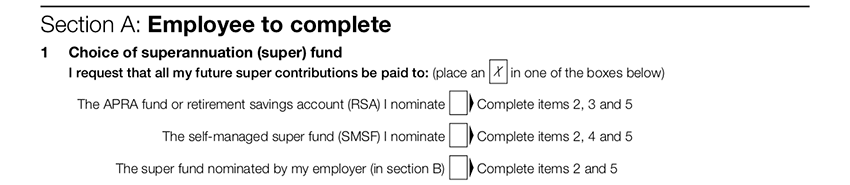

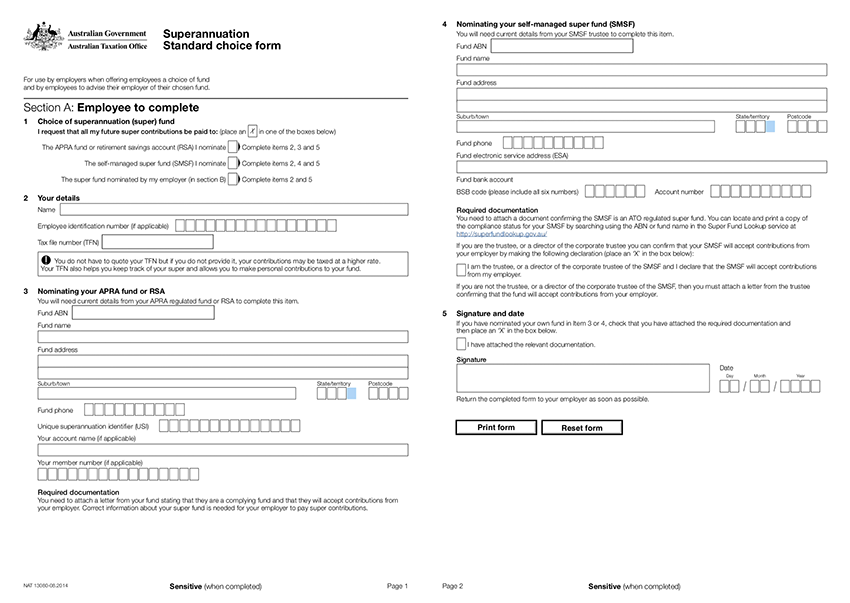

Section A (1) - Choice of superannuation (super) fund

The first part of the form you will need to fill out looks like this:

This is where you’ll indicate what type of super fund you’d like your super money to go into. If you’ve got an account with a retail or industry super fund, you should put an X in the first box where it says ‘The APRA fund or retirement savings account (RSA)’. All superannuation funds are regulated under APRA, and therefore called an ‘APRA fund’. If you’re with Student Super, you should check this first box.

A retirement savings account or (RSA) is a type of long-term savings account, provided by a bank, building society, credit union or life insurance company, however RSAs are now fairly uncommon. RSAs are grouped together with APRA funds on this form.

If you’ve got a self-managed super fund, you’ll almost definitely know it. Your fund will require an annual audit and there will be a lot of work to manage your super. If you’re with Student Super, make sure that you don’t check the second box.

Lastly, if you haven’t got a super fund, your employer will sign you up to a fund of their choice. This is the last box in the list so if you’ve got an existing fund, make sure you do not tick this box.

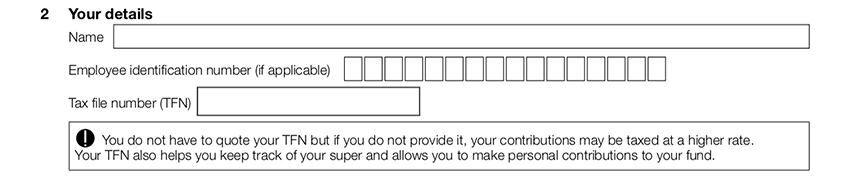

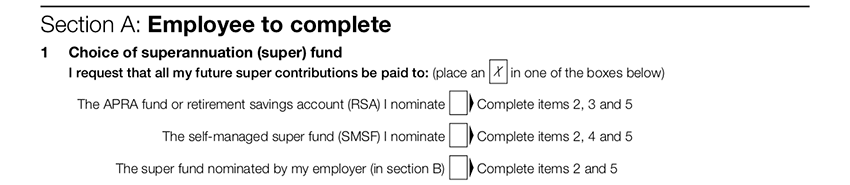

Section A (2) - Your Details

This is where you’ll need to put your name on the form, and your TFN if you’ve got it ready.

The employee identification number is specific to your place of employment, so for example if you’ve got a staff number or other identifying information that the HR department needs, you’ll put it there. They should let you know if you need to include it so if you’re unsure, just double check with your employer.

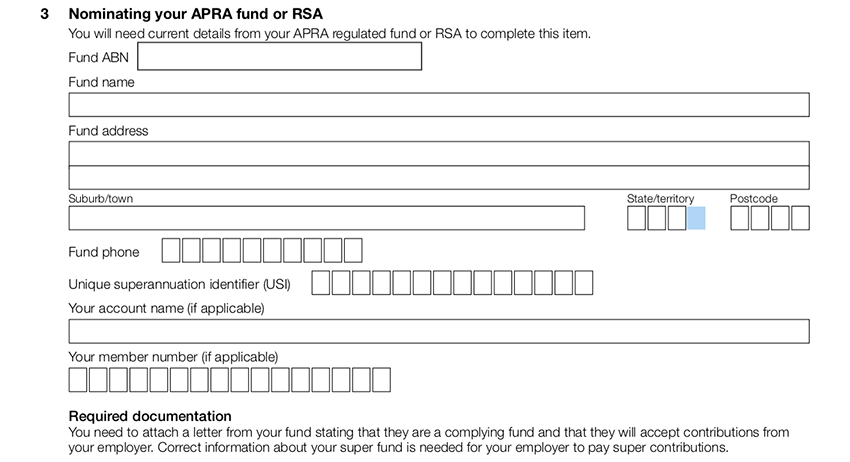

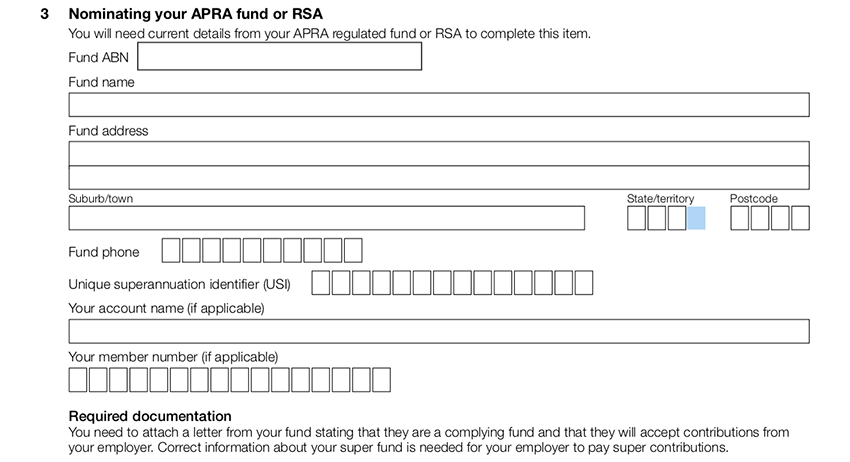

Section A (3) Nominating your APRA fund or RSA

If in Section A (1), you ticked the first box where it says you have an APRA fund or RSA, so you’ll need to fill out this part. You should be able to find most of this information online, either through Google or on the website of your actual fund.

Firstly, you need to fill out your Fund ABN - this is the Australian Business Number of the fund you’re with, and you can usually find it on the footer of the fund’s website, or if you search for the full name of the fund on

ABN Lookup, you’ll be able to find it there.

Student Super has made it easy by listing the ABN at the bottom of every page on the website, as well as on our pre-filled super nomination form which you can find

here.

Secondly, you’ll need to put the full name of your super fund. Sometimes, this can be different to the name that you’re used to calling it. For example, Student Super’s full fund name is Student Super Professional Super so when you’re looking up your fund’s ABN, just check for the full fund name too.

You’ll then need to put the address of your fund. You can find this by googling your fund, or if you’re a Student Super member, you’ll find it on your

pre-filled super nomination form.

The next section is a bit tricky. You need to find the Unique Superannuation Identifier (USI). As there are a fair few super funds out there, each one has a USI that helps identify which fund it is. A fund’s USI can usually be found on their website, but it can be tricky to find. It’s a good idea to look at the Letter of Compliance or in frequently asked questions. For Student Super members, it will be on your

pre-filled super nomination form.

Your account name and member number are unique to you and your fund. This is how your fund identifies you. They can usually be found on any welcome letters, emails or online if you have an online account. Student Super members can find their name and welcome number on their homepage as soon as they log in, as well as on their

pre-filled super nomination form.

The last little line that says “Required documentation” means you’ll need to find the ‘Letter of Compliance’ from your super fund. This is basically a standard letter that your super fund issues, which states that they’re a complying fund, and are happy to receive your super contributions on your behalf. You can usually find this online or on the fund’s website. Student Super mails out a welcome pack to every member with multiple printed copies of this, so you won’t have to go searching for it and you’ll have them on hand when you need them. You can also find this form

here.

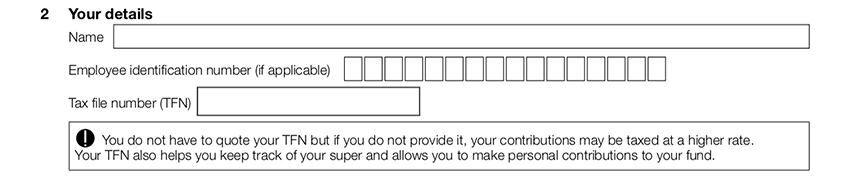

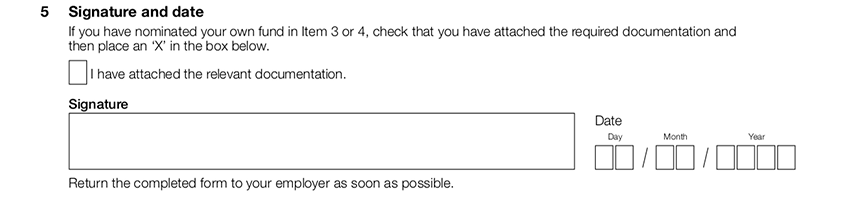

Section A (5) Signature and date

You’re nearly there!

This is the final part that you’ll have to complete.

If you’ve printed your fund’s letter of compliance, put an X in the box that says you’ve attached the relevant documentation. Then, all you have to do is sign and date the form and you’re all done! Now you just have to give this form and the letter of compliance to your employer so they can start paying you your super.

Student Super has made it easy for you to tell your employer. Every new member will receive a welcome email that contains a copy of the letter of compliance, and a pre-filled super choice form. Members can also get a copy at any time by going to

Tell Your Employer. The pre-filled super choice form contains all of the info you need, so you can give that one straight to your employer in place of this ATO Superannuation Standard Choice Form. However, if your employer doesn't accept Student Super's version, all you need to do is copy across the relevant info!

You can also find all the other important documents you need

here!

Student Super’s Fund Information

Fund ABN: 43 905 581 638

Fund name: Student Super Professional Super

Fund address: PO BOX 886 Wollongong NSW 2500

Phone: 1300 646 960

USI: 43 905 581 638 021